Bitcoin & Blockchain Wallets

Updated September 2020

This article/page was first written on one of my websites: www.d9club.siterubix.com back in early 2017.

Bitcoin and Blockchain have come a long way since then.

Table Of Contents

What is Bitcoin?

Bitcoin is better ‘Experienced’ than ‘Explained.’ – Andreas Antonopolous.

What is Bitcoin you ask? ‘Bitcoin is not Money’ says a Florida judge in a ruling made on July 22, 2016.

Ironically, this ruling provides a boost to the use of the crypto digital currency which has remained in the shadows of the financial system because it means that no specific license is required to buy and sell bitcoins. Read the full article here.

Bitcoin is a digital currency that was created in 2009. It follows the ideas set out in a white paper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms and is operated by a decentralized authority, unlike government-issued currencies.

There are no physical Bitcoins, only balances associated with public and private keys. These balances are kept on a public ledger, along with all Bitcoin transactions, that are verified by a massive amount of computing power. –Source Investopedia.

Follow Investopedia: Investopedia on Facebook

What Is Bitcoin – Video Run-Time: 12.48

What Is A Blockchain?

“Blockchain is Coming and It Could Save Lives.” Click on the image to the left to watch a very important video.

The World Economic Forum, the international organization best known for its annual meeting of academics, intellectuals, capitalists, and policymakers in Davos, Switzerland, has unveiled an explainer all about blockchain technology, the same technology that underlies the digital currency, Bitcoin.

Presented to such an influential audience, this lends credibility to the technology as more than just a passing fad and something to be paid close attention to.

Bitcoin and Blockchain Technologies are actually here and they are going to do more than ‘just save lives’ they are going to ‘Enhance and improve lives.’

If you would like to continue learning about these revolutions, It is recommended that you follow the work of Andreas Antonopolous the bitcoin and open blockchain expert. See His Personal Biographical Website Here.

Blockchain Technology Review

Since it was founded in 2011, Blockchain, which is based in Britain (with offices in Luxembourg and New York), has gained respect in the industry for adhering to the virtual currency’s original philosophy of anonymity and decentralization.

Bitcoin has been slow to gain more widespread use in the mainstream. In developed countries, virtual money is still largely the plaything of technology enthusiasts and speculators, though some retailers and stores have trumpeted their acceptance of Bitcoin. In emerging markets, where some see enormous potential for Bitcoin, the infrastructure to process transactions simply does not exist.

For Bitcoin to become more widely adopted, supporters say, the virtual currency must find a unique application that will take it beyond the realm of speculation. And for that to happen, companies must first build a robust platform, which is what Blockchain says it is trying to do.

In this Bloomberg Interview (below), Blockchain president Peter Smith discusses the company’s business model and the security concerns surrounding Bitcoin with Trish Regan on “Street Smart.” (Source: Bloomberg)

Bring on Bitcoin: Digital Currency Vs Paper Money

Click on the image below to watch the Video

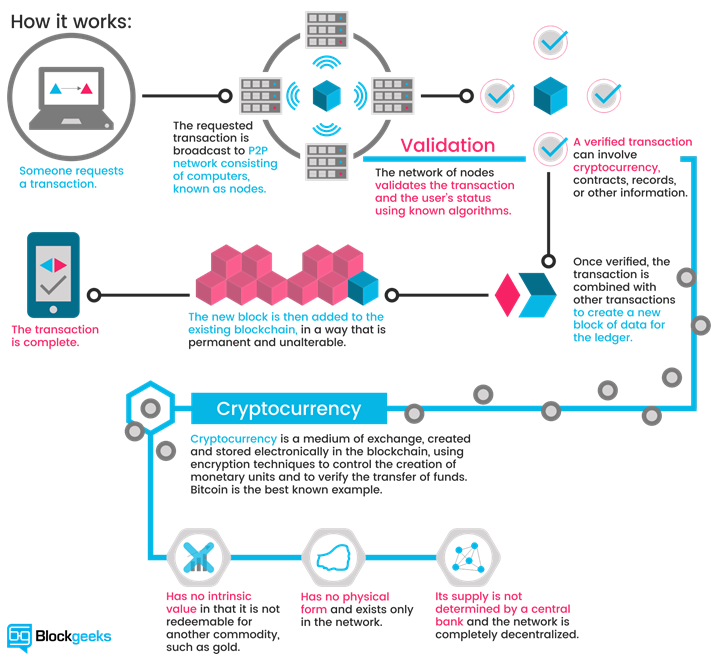

How Blockchain Works

Blockchain Technology is a PROTOCOL. Here is

Additional Resources:

An Entry-Level Talk About Bitcoin.

Presented at the Singularity University’s Innovation Partnership Program, this talk by Andreas Antonopolous is an entry-level talk about bitcoin.

The video, categorized as Science & Technology and Licensed as a Creative Commons Attribution License, means that reuse of this video is allowed. Please feel free to Share with Others.

“Bitcoin Is Probably Bigger Than The Internet.”

Video Timeline:

If you just want to ‘skip’ to certain parts, here is the video timeline:

- 0:16 – “Good morning everyone. How many of you have used a digital currency at least once and how many of you own Bitcoin or a Digital Currency?”

- 1:28 – “I’ve spent the last five years trying to explain ‘Bitcoin.'”

- 1:52 – “let’s start from the basics.”

- 5:48 – “In History, there have been 5 major changes or ‘exchanges.’ Bitcoin is not Money. Bitcoin is The Internet of Money. Money is a language.”

- 9:24 – “We are on the verge of a new transformation of money. Bitcoin and Blockchain technologies unify ‘The System of Money’.”

- 13:08 – “If you look at this as just the application of money…you are missing the point.”

- 15.20 – “Toddlers invent money in ‘Kindergarten’ to strengthen bonds.”

- 17:15 – “With Bitcoin, I have control of my money.”

- 19.10 – “We are a ‘Privileged society.’ The rest are not. ‘Giving access to the other 6 Billion comes through Bitcoin and Blockchain Technology.”

- 22.27 – “The rate of exponential growth has already started. Do not underestimate this. The ‘Internet of Money’ was launched in January 2009 and it is coming faster than you can understand. It is a Gift.”

- 25:04 – Questions and Answers.

“The banks want the efficiency of bitcoin without losing any of their control.”

Read below some excerpts from an interview with Andreas Anatopolous on “The Futurism of Bitcoin.”

The Futurism Of Bitcoin

Click on Image to Video Link “Experts Predict The Future of Bitcoin.”

The technology behind Bitcoin could transform our society and upend some of our oldest institutions.

Andreas Anatopolous has been interested in cryptocurrencies since the early 1990s. In many ways, his interest stems from his experiences growing up in Greece. He saw the way a currency crisis could wipe out the wealth of an entire generation, and it had a big impact on him.

He says that his current interest in cryptocurrencies was rekindled in 2012 when he re-discovered bitcoin and began to look into its capabilities in more depth. He is a strong believer in the promise of the Internet to help to re-organize society around global network-centric institutions as opposed to hierarchical structures of power.

The Magic Of Bitcoin

Andreas Antonopoulos explains Bitcoin as the Internet of Money. THIS IS AN EXTRACT FROM ORIGINAL VIDEOCLIP THAT CAN BE FOUND HERE: https://www.youtube.com/watch?v=O1BMk…

Category

License

Standard YouTube License

“The blockchain is a distributed database… The magic of bitcoin comes from sharing control over that distributed database through a consensus mechanism called ‘Proof of Work.’ This ensures that no one is in control of bitcoin and that it operates based on predictable rules….”

“…Using those fundamental features, bitcoin can securely record transactions that represent the movement of currency between owners, without any central authority or point of control. This creates a distributed currency and payment system that is simultaneously secure, open, and global….”

He goes on further to say that Institutions are the organizing model of industrialized societies. “In my view, bitcoin represents the new reality of an organization in an information society. The Internet has already given us the means to organize that is based on networks rather than institutions or hierarchies. Bitcoin extends that to money, creating a network-centric model of organization that does not depend on institutions.”

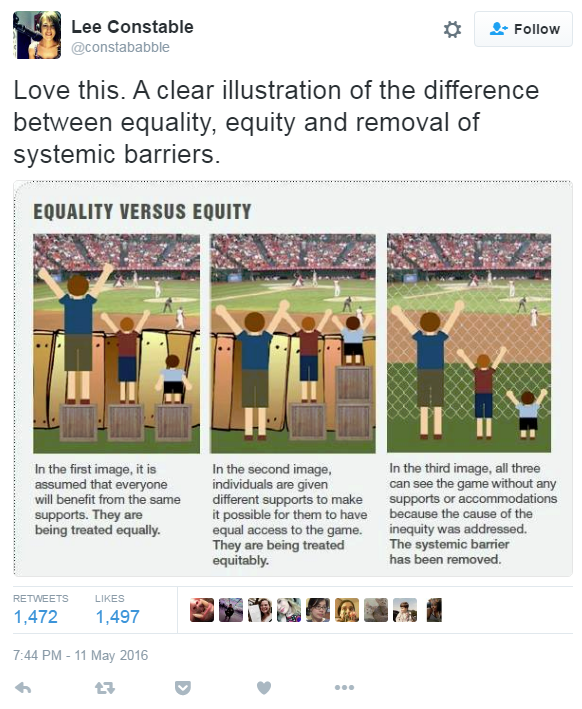

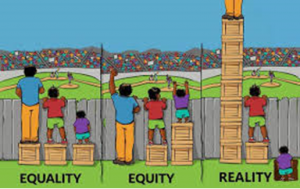

Equity, Equality & Reality…

“…Equity is guaranteed by a neutral application of rules and by a decentralized validation network: all transactions are treated equally in bitcoin without censorship or control by any party. There is no central lever of power in bitcoin to co-opt or corrupt that can give advantage to anyone in particular. Instead, power is spread out across the network, making it very difficult to distort….”

“…In the past we needed institutions of oversight to manage institutions of power. Bitcoin makes both unnecessary. Banks are finally past the stage of denial and are now in the bargaining stage. They’re facing a highly disruptive technology and are not sure how to respond. They can’t buy, co-opt, de-claw, sue, or ban this technology and, consequently, are attempting to separate bitcoin from its characteristics of openness, decentralization, borderlessness, and permissionless access….”

Bitcoin/Blockchain Remove Systemic Barriers…(see the illustration above).

“…In reality, the bitcoin model can never be adopted into the existing banking structure (hence the bargaining). The solution of banks is to focus on the distributed database and try to ignore the things that make bitcoin disruptive. Just as the initial corporate response to the Internet was to create walled-gardens of curated content (i.e., Compuserve, MSN, intranets, etc.), the response of the large banks has been to try and remove the disruptive elements from bitcoin by creating a milder, tamer version….”

“…However, the really interesting and transformative properties of bitcoin come from the eradication of borders and the elimination of centralization….”

“…What makes bitcoin free, open, and borderless is the decentralized Proof-of-Work consensus algorithm. It is this algorithm and its’ anonymity that makes it unpalatable to banks. In other words, what the large banks call a “blockchain” is really an Intranet of Money. Whereas bitcoin and its open blockchain is the Internet of Money….”

“…As with the many industries disintermediated by the Internet, banks will survive. But they will be fundamentally changed and their power and profitability will be significantly reduced. They can’t adapt and they can’t stop this disruption….”

Disruptive Innovation…

Image Courtesy of Slideshare.

“…The essence of disruptive innovation is that it can’t be “managed.” It won’t be predictable, and it won’t be smooth. It challenges fundamental assumptions and institutions with centuries of history. Yet, the technology has been invented and cannot be un invented. Those who adapt to change and are able to absorb high rates of innovation will be successful in navigating this new reality….”

“…Some societies will be more comfortable with the idea that individuals have ultimate control over their money and more accepting of self-determination, freedom of association, and freedom of expression. Some societies will not….”

“…Since the 1970s money has become more and more digital. For many governments, this holds the promise of enabling greater levels of control and surveillance over the financial activities of the entire world; however, that dream ended with the introduction of bitcoin, as it offers an escape hatch from the surveilled and controlled straight-jacket of modern banking. Bitcoin thus becomes a litmus test….”

If your government is fearful of individual control of money and financial privacy, you should really take a closer look at your government and its priorities.

Blockchain Detailed:

“Unimagined new networks will evolve to meet society’s needs more cheaply and potentially more securely…”